Table of Contents

When shopping for the best POS system for your business, you will be looking for many of the same requirements as most retailers – easy-to-use system that lets you ring up items, accept payments, and print a receipt.

Most point-of-sale software vendor charge a one-time license fee or a recurring monthly fee – or both. Square has a different business model. It offers clear flat rate transaction fees, no monthly fees, no required long-term commitments. This simple free POS system allows all different types of businesses to accept credit and debit card payments.

How can Square do this? Since it entered the market, Square has done things differently.

Scale Advantages

Square claims that more than 4 million merchants use its free POS software.

The majority of these are likely micro merchants that use a Square payment dongle or block with an tablet or smart phone. These range from small cafes, street vendors, nonprofit organizations such as churches and schools and dentists’ offices. None the less, that is a lot of merchants!

The large size of Square allows it to add new features at a lower cost per user than its competitors. Plus it can spend big on advertising and promotions and subsidies on its POS hardware. Small merchants benefit from this scale.

Its Fees Are Not the Lowest

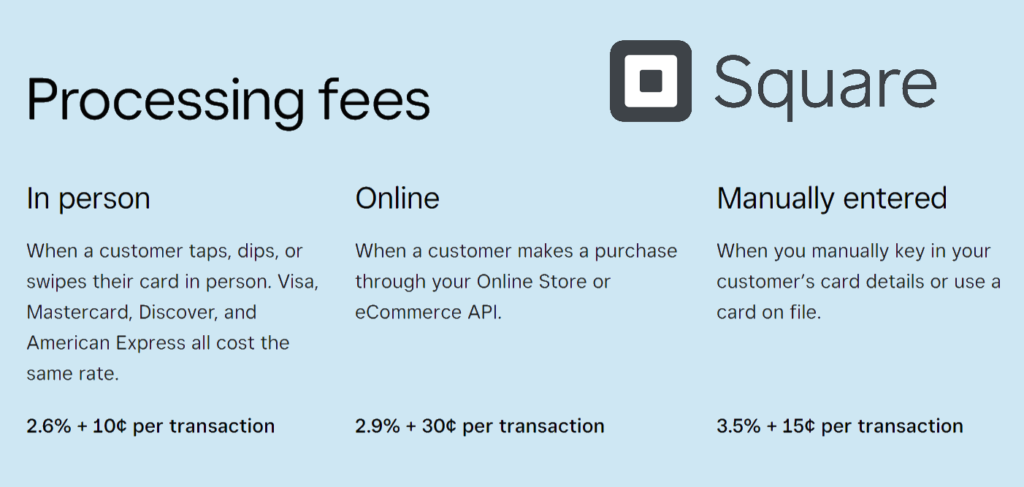

Square’s transparent fees are current listed in 2014 at 2.6% + 10¢ per card-present transaction and 3.5% + 15¢ for manually keyed-in card payments. These are by no means the lowest in the industry. Because of this, a transaction processed on Square generates more profits than other it does on other free and paid POS software with lower processing rates.

Good Payment Features for the Money

Square’s free offering is focused more on payments than retail store management. As Square makes money for each transaction processed, it has included some nice payment features. These features help attract small business, driving transaction volume for Square.

- Accepts multiple payment types (magstripe, chip (EMV), and NFC payments like Apple Pay with Square Reader for contactless and chip).

- Ability to turn your computer into a web POS with virtual terminal

- Digital and printed receipts

- In-app or written tip management

- Open tickets and split tender

- Offline payments

- Recurring payments

- Card on File

Simple Pricing Plan

Prior to Square, payment processors used all sorts of methods to layer in hidden fees. Some just added the fees without hiding them, hoping the merchant would not notice. Statement fees, deposits fees, security fees, risk assessment fees, batch fees, annual fees, monthly fees, card assessments, etc. And many processors still do this!

Square changed the industry with its transparent flat rate pricing plan. With Square, the fees from the different card brands are included in Square’s fees, so there are no charges from the different credit card brands. Every card brand (MC, Visa, Amex, DSC) and every card type (debit vs simple credit vs high rewards credit) has the same rate.

There is no other recurring monthly fee. While many payment processors associated with other free point-of-sale software providers charge a monthly fee, with Square’s free POS there are no long-term commitments required and no hidden fees.

This attracts many small merchants wary of locking into an unfavorable processing contract or plan.

Attractive and Low Cost Hardware

Square offers slick and modern POS hardware/credit card terminals. At the low end, the dongles and swipes are free to low cost items. Even for the larger terminals, the price is fair. Square uses a razor/razorblade approach. It offers the hardware at a low process to lock in the higher margin processing revenue.

Room To Grow

While Square was established to give small business owners an easier way to take credit cards, over time that have developed solutions for different sized business. In addition to the free system, Square offers a paid retail management solution, business tools and equitable loans that give business access to funding.

The ability to grow with Square or participate in some of the other services offered through Square (loans, same day funding, loyalty plans) can be very attractive for smaller retailers.

So How to They Do It?

Square’s free POS solution provides a good entry point for small businesses. It’s modern, simple to use and reliable. While Square does not have the cheapest option in the market given its relatively high flat rate fee – Square also has a reputation for not deceiving or ripping off its merchants.